Well-functioning capital markets rely on high-quality information flows between firms receiving capital and the investors who provide it. Analysts, auditors, and corporate managers, along with regulators and their agencies, are central to these information flows.

As independent professionals who protect the interests of dispersed investors by verifying or assessing corporate information, auditors and analysts are commonly regarded as “gatekeepers in capital markets”. However, there has been growing concern that these gatekeepers’ private incentives, along with unintended consequences of the regulations targeting them, can undermine their effectiveness.

Assistant Professor Nanqin Liu from the Department of Finance at the Southern University of Science and Technology (SUSTech) has published a paper in The Accounting Review, a top academic journal in the accounting discipline and recognized by business schools worldwide. The paper is entitled “Financial Reporting, Auditing, Analyst Scrutiny, and Investment Efficiency.”

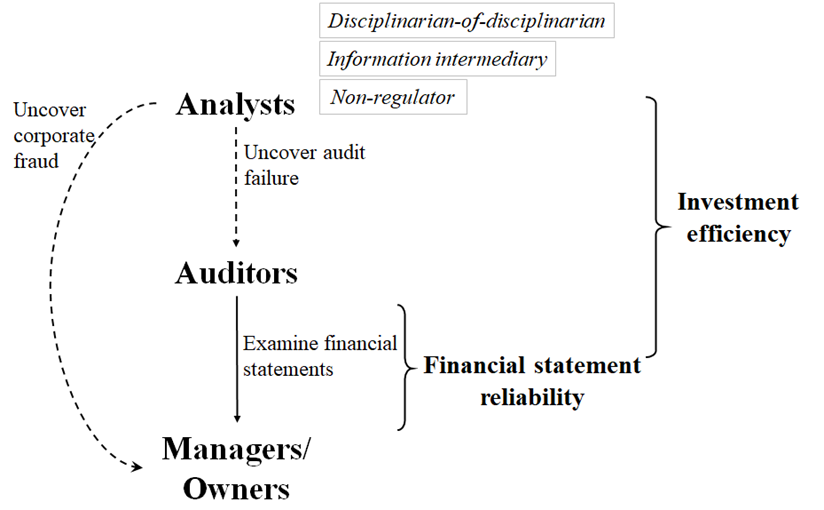

Along the analyst-auditor-owner disciplinary chain, the auditor examines the financial reports prepared by the owner, and the analyst uncovers financial misreporting as well as audit failure. The owner’s misreporting behavior and audit quality jointly determine financial statement reliability, which together with analyst scrutiny affects the information available to investors and hence investment efficiency.

Prof. Nanqin Liu’s paper shows that although analyst scrutiny ex-post detects misreporting, it ex-ante aggravates the owner’s misreporting behavior and further impairs financial statement reliability if the legal penalties for the auditor and the owner are minor.

Figure 1. Disciplinary chain

She also shows how the effects of regulation depend on its target’s disciplinarian(s). Firstly, although enhancing the auditor’s legal liability always increases audit quality and financial statement reliability, it decreases investment efficiency if the analyst is highly independent. Secondly, increasing the owner’s misreporting penalty reduces investment efficiency if either of (but not both) the regulations on the auditor and the analyst is strict.

Assistant Prof. Nanqin Liu and Associate Prof. Derek Chan from the University of Hong Kong (HKU) are the only two authors of this paper. Nanqin Liu is the only corresponding author.

Nanqin Liu joined SUSTech as an assistant professor in 2021. Her research interests mainly include auditing, corporate disclosure, and the interface between finance and operations management.

Paper link: https://doi.org/10.2308/TAR-2020-0287

To read all stories about SUSTech science, subscribe to the monthly SUSTech Newsletter.

Proofread ByAdrian Cremin, Yingying XIA

Photo By