Interest rate variance risk premium (IRVRP), the difference between implied and realized variances of interest rates, emerges as a strong predictor of Treasury bond returns of maturities ranging between one and ten years for return horizons up to six months. IRVRP is not subsumed by other predictors such as forward rate spread or equity variance risk premium. These results are robust in a number of dimensions.

Hao Zhou, Chair Professor of the College of Business at the Southern University of Science and Technology (SUSTech) and Unigroup Chair Professor of Finance at the PBC School of Finance at Tsinghua University (THU), collaborated with Dr. Olesya Grishchenko, Principal Economist of the Federal Reserve System, and Professor Song Zhaogang of the Kerry Business School at Johns Hopkins University (JHU), where they recently published a paper on the short-run and long-run risks associated with the term structure of interest rates.

Their study, entitled “Term Structure of Interest Rates with Short-Run and Long-Run Risks,” was published in the Journal of Finance and Data Science (JFDS), a leading analytical journal on finance and data science, providing detailed analyses of theoretical and empirical foundations and their applications in financial economics.

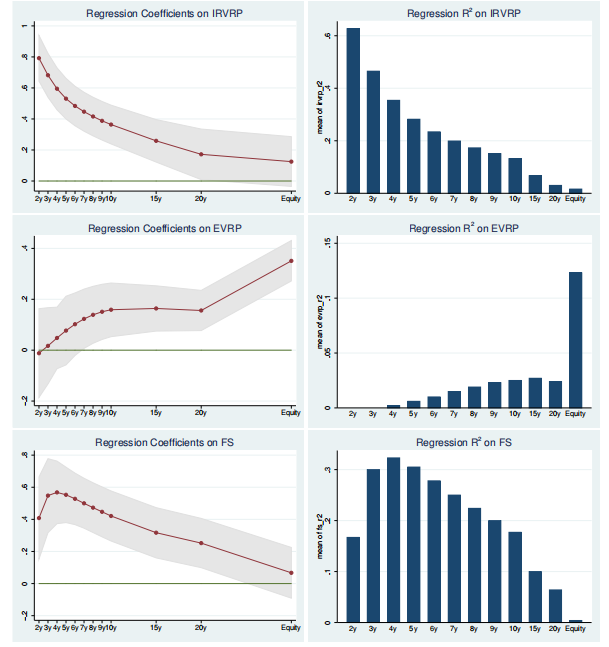

In their research, Prof. Zhou and his collaborators rationalized their findings within a consumption-based model with long-run risk, economic uncertainty, and inflation non-neutrality. In the model, interest rate variance risk premium is related to short-run risk only. At the same time, standard forward-rate-based factors are associated with both short-run and long-run risks in the economy.

Figure 1. Diagram of interest rate variance risk premium

Figure 2. Yield predictive comparison

Figure 3. Model-implied nominal bond yield loadings on expected consumption growth

Their model qualitatively replicates the predictability pattern of IRVRP for bond returns.

Prof. Hao Zhou is the first author of this paper. SUSTech is the first corresponding unit.

Paper link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4086949

To read all stories about SUSTech science, subscribe to the monthly SUSTech Newsletter.

Proofread ByAdrian Cremin, Yingying XIA

Photo By