Due to market frictions and principal-agent problems, firm value is influenced not only by tax shields and bankruptcy costs but also by complex conflicts of interest among managers, shareholders, and creditors. These conflicts often result in an efficiency loss in investment. While existing theoretical literature has separately examined owner-manager and shareholder-creditor conflicts, their joint effects and dynamic interactions remain open.

A recent study by Ph.D. student Nanhui Zhu from the College of Business at the Southern University of Science and Technology (SUSTech), in collaboration with his two academic advisors—Associate Professor Zhaojun Yang at SUSTech and Associate Professor Yunzhi Hu from the University of North Carolina at Chapel Hill—has identified two commonly observed phenomena in corporate operations. First, managers may divert part of a firm’s profits for private benefit, leading to overinvestment. Second, shareholders operating under debt obligations may forgo valuable investment opportunities, a situation known as “debt overhang”, leading to underinvestment. This work investigates whether the opposing distortions induced by these two agency problems can be leveraged to achieve firm-optimal investment decisions.

Their paper, titled “Optimal Ownership and Capital Structure with Agency Conflicts”, has been listed in the Forthcoming Articles in the Journal of Financial and Quantitative Analysis (JFQA), a top-tier journal in the field of finance.

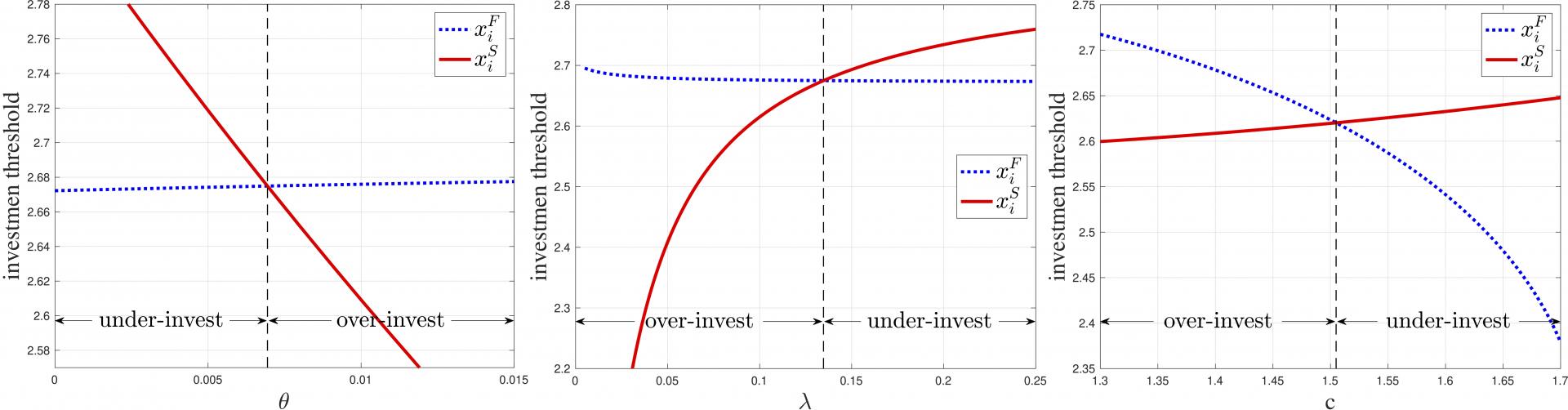

By rigorous theoretical derivations and numerical simulations, the researchers developed a unified continuous-time framework based on real option theory. The model explores the interaction of different agency conflicts and their implications for corporate investment and financing policies. The study identifies three key forces—diversion effect (incentivizing overinvestment), cost-sharing effect (mitigating overinvestment), and debt overhang effect (inducing underinvestment)—and shows that under certain conditions, these forces can exactly offset each other, thereby realizing the firm-optimal investment outcome and resolving agency conflicts in investment decision-making.

Figure 1. Investment thresholds versus diversion rate, managerial ownership, and coupon payment. Under specific conditions, the countervailing incentive effects can exactly offset each other, achieving firm-optimal investment outcomes.

The findings suggest that seemingly inefficient governance structures might actually help achieve efficient investment outcomes by balancing competing distortions. Further, the paper determines the firm’s optimal ownership and capital structures, revealing how the trade-offs among agency conflicts, tax shield benefits, and bankruptcy costs jointly shape a firm’s financing structure. The model offers novel theoretical explanations for empirical patterns documented in the literature, including the relationship between ownership concentration and firm value and the financing preferences of family-controlled firms.

This study was conducted as part of Nanhui Zhu’s doctoral research during his integrated master’s and Ph.D. program under the joint supervision of Associate Professors Zhaojun Yang and Yunzhi Hu. Dr. Zhu is the sole corresponding author of the paper and will join the China School of Banking and Finance at the University of International Business and Economics (UIBE) as a faculty member upon graduation.

Paper link: https://jfqa.org/2025/04/25/optimal-ownership-and-capital-structure-with-agency-conflicts/

To read all stories about SUSTech science, subscribe to the monthly SUSTech Newsletter.

Proofread ByAdrian Cremin, Yilin ZHOU

Photo ByYan QIU