Unlike small-scale workshops, Modern enterprises are inseparable from the cooperation between investors (particularly, venture capitalists (VC) enterprises) and entrepreneurs, which involves both capital and labor inputs (such as advisory services from investors, etc.). However, due to information asymmetry in the process of business operations, these inputs are often difficult to specify via contracts in advance. To encourage stakeholders to invest capital, labor, and other resources, a well-designed incentive mechanism is essential, in which a fraction of equity split is a common incentive tool. Fixed payments alone lack motivational effects, but they can be exploited to balance the interests of all parties and ensure the fairness of the contract.

A central question arises: How should equity be allocated to achieve the best incentive effect? The conventional approach typically splits and distributes equity by the amounts of the stakeholders’ contributions. However, these seemingly reasonable practices are unscientific. The primary deficiency lies in its failure to provide effective incentives for partners while pursuing fairness and reasonableness. The failure of many enterprises can be attributed to the absence of an effective incentive mechanisms.

Equity allocation is one of the most important challenges that VC enterprises need to solve. It is generally determined by the contribution of partners. However, research from Professor Zhaojun Yang’s group from the College of Business at the Southern University of Science and Technology (SUSTech) suggests this approach is bad practice. They derived a concise mathematical formula for equity allocation, revealing that it should be totally determined by the output elasticity of project inputs rather than the inputs themselves.

Their study, titled “Optimal equity split under unobservable investments”, has been published in the International Journal of Industrial Economics, a journal of the European Association for Industrial Economics Organization. It was selected as one of the magazine’s leading articles for 2025.

This work uses the theory of financial contracting theory and borrows the Cobb-Douglas production function model’s idea to develop a simple and effective method for equity split. It regards the probability of project success as a function of capital and labor inputs, modeled using the Cobb-Douglas function. According to the researchers, this is the first mathematical formula of equity split based on theoretical calculations.

The formula shows that the proportion of equity split is completely determined by the output elasticity of the input factors, and has nothing to do with the cost and quantity of the input factors. They argue that the optimal contract is to allocate equity in an incentive-first way and balance the interests of the partners with cash compensation. Therefore, this approach can not only ensure effective incentives, but also meet fair and reasonable requirements.

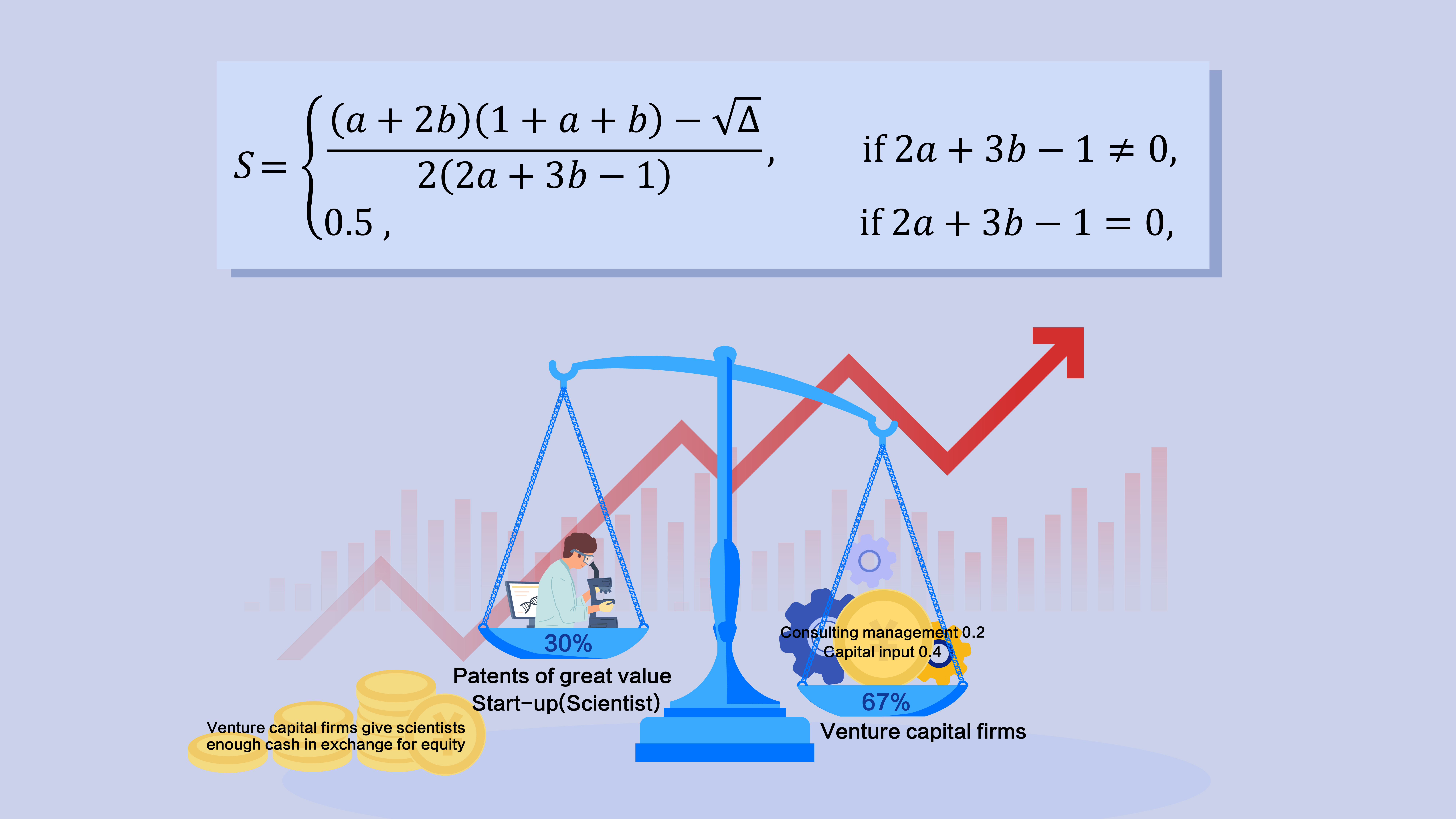

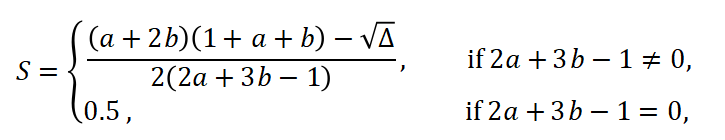

Assuming that the output elasticity of consulting management and capital input (that is, the sensitivity index of output change to input factor change) of VC firms is a and b, they prove that the equity share allocated to VC should be

where Δ= (a+2b)(1+a+b)[a2+3a(b-1)+2(b-1)2]>0.

For example, if the output elasticity of VC’s consulting management and capital input are 0.2 and 0.4, respectively, then the equity of VC should be calculated as 67%. However, if the patent value of the start-up (scientist) is so high that the VC can only obtain 30% of the equity based on a fair standard, the VC should compensate the scientist with enough cash to maintain a 67% equity stake, ensuring optimal incentive effect.

Ph.D. graduate Lihua Tan is the first author of the paper, with Professor Zhaojun Yang serving as the corresponding author.

Paper link: https://doi.org/10.1016/j.ijindorg.2024.103132

To read all stories about SUSTech science, subscribe to the monthly SUSTech Newsletter.

Proofread ByAdrian Cremin, Yuwen ZENG

Photo ByYan QIU